9th of June 2022

Last week we met with Dumitrita Ghenciu, Employer Branding Strategist @ Bosch Romania and Dragos Gheban, Managing Partner @ Catalyst Solutions and we discussed the ins and outs of measuring employer branding. Dumitrita shared with us her experience on what, how and when to measure and Dragos gave us perspectives on the Romanian market as far as successful employer branding is concerned, with the associated strengths and challenges.

Below you can find a summary of what was discussed in case you missed the event or forgot to take notes. We hope you find it useful, have a good read and see you next month!

EBdialogue Takeaways – KPIs in Employer Branding: luxury or must have?

The Why.

One of the main reasons why we need to measure employer branding indicators is because we need to be able to account for our efforts, to make sure we meet our employer branding objectives and justify the need for investment in our resources.

The What.

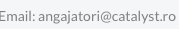

The list of macro indicators that we use to measure progress on EB strategy implementation is rather short. If we stop to think about it, everything we implement – and subsequently measure on employer branding, takes place along the funnel.

- Firstly, we want to have a high level of awareness. When we have built salience for our employer brand, by the time they see our job openings, candidates will already be aware of our organization’s existence on the market and the scope of its work.

- Then we look at consideration. Not only do we want candidates to know who the organization is and what it does, but we want them to take us into consideration when they look for a job. We cannot build consideration without having previously built on awareness.

- And then comes desire – this indicates the extent to which candidates want to work for our organization. Bear in mind, that application is not necessarily an indicator of desire because candidates can apply to job openings even if they do not necessarily want to work for our organization (e.g. for lack of more appealing job openings at the time of application, rejection by their most desired employer, etc.)

- Then we work on our application We built salience and consideration, the next question we can ask ourselves is how many candidates apply to our job openings?

Besides what is measurable on the funnel, there’s a 5th indicator: attributes associated with the brand. This entails that there is a desired positioning of the employer brand of the organization and what we want to measure is how exactly candidates perceive us and how large is the gap between our desired positioning and their perception. This type of measurement could be extremely helpful for companies that are new to the market and need to recruit candidates from a talent pool that does not (yet) associate the organization’s employer brand with attributes that are relevant to them. Organizations with more mature employer brands can also benefit from this type of measurement. For instance, they can use them in communication campaigns that promote their employer’s brand to their target groups.

Apart from macro-indicators, we also have micro-indicators and these are KPIs that relate to channel and HR marketing campaign performance. We’ll talk later about them.

The how – sources and how often should we measure?

Funnel and brand associations

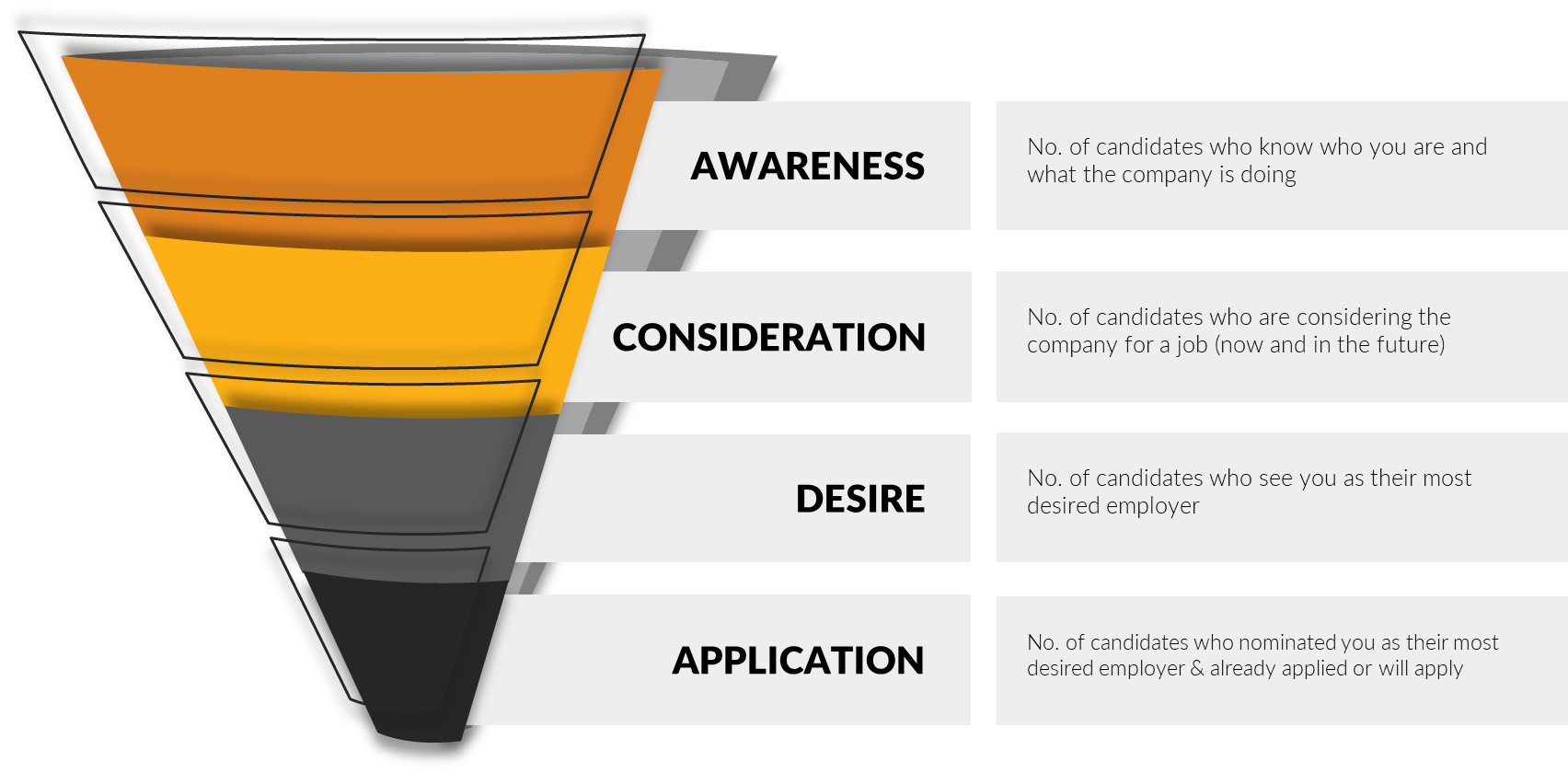

One of the sources we can use are external surveys. They can be available on the market and carried out by local or international providers ( such as the Most Desired Employers survey that is run yearly by Catalyst Solutions ) or we can choose to work with an agency to design a custom external survey. Whilst the first is a standard but the more accessible solution in terms of budget and timing, the latter gives us the option to customize the survey to make sure we target exactly the group we need and ask exactly the questions we want to ask. But it is more costly and implementation is more time-consuming. In such surveys, we will usually find data on all funnel-related indicators (awareness, consideration, desire and application) and attribute associations with the brand. Depending on how the survey is structured, we need to measure all these indicators for our organization and for that of our most important competitors. Competitors are not our commercial brand competitors, but these are our competitors in recruiting.

Whilst we can find application data in such surveys, we may also opt for using internal data instead: every organization collects data on how many candidates actually apply to an opening, whereas external surveys will measure intention to apply. We may find the first is more accurate than the latter for measuring the level of application, but it must be collected in a structured and consistent way.

“At Bosch Romania, we take our data on awareness, consideration, desire and brand associations from the Most Desired Employers survey ran by Catalyst Solutions, but for rate of application we use internal data. We also look at trends in our position in the top most desired employers, per target group, across time. However, we only use the positioning in the top as a general guideline – this shows us that we are on the right track. But what happens is that if our position in the top changes, this may be due not only to our actions, but also to changes in the market. From this point of view, we work in a volatile environment – what our competitors are doing impacts our talent pool too. For example, before the pandemics we were already discussing to do more digitally and data show that after the pandemics there was a boom at Bosch Romania in this area. But is it correct for me to attribute this boom to our activities solely? I wouldn’t say so because what we saw is that the pandemics obliged everyone to go digital. In our experience, when you do not take this into account, a change of +/- 3% on your level of awareness or consideration can become very hard to explain. Lastly, it is important to mention that marketing methodologies can be of great help in measuring progress on your EB and that it is an ongoing process so patience and perseverance are required” Dumitrita Ghenciu, Employer Branding Strategist @ Bosch Romania

If external surveys are not an option, organizations can collect data internally. Think of adding just 3 questions that every recruiter can ask at the beginning of every interview with candidates: Did you hear of the organization prior to applying? What did you know about the organization prior to applying? and What do you associate the organization most with?. This is of course only an example, but imagine that if we do this for, say, 1 year and we have a large enough recruiting volume, only these 3 questions can provide us with enough data to get us started. The only mention here is that the collection must be done in a structured way (all recruiters must ask the same questions) and consistently.

“Next to data from Most Desired Employers on brand associations, we also collect data internally. We generally conduct deep dive interviews which we then analyze once per year, on different target groups (e.g. newcomers or those who leave) and this helps us get a pulse of what our employees think and also generate content for brand communication campaigns – they help us bust myths about life as an employee in Bosch. One piece of advice: do not underestimate the informal channels through which you can get your insights, especially if you are a smaller organization. Small talks during a coffee break, and talks with a couple of HR BPs colleagues that participate in career development discussions can already be valuable sources of information. And also make sure to discuss with your detractors. The truth is that, behind what may seem like an exaggeration, detractors usually voice things that reflect also other employee’s thinking so do not underestimate the input you can get from them.” Dumitrita Ghenciu, Employer Branding Strategist @ Bosch Romania

The funnel-related data and brand associations, because they encompass such macro-elements of our branding, should be measured less often than other indicators. Depending on how many activities we are running, we could consider measuring them once a year. This is because the impact of our actions at any level of the funnel or brand associations will take a longer time to show itself. However, we need to remember to always measure the baseline, particularly if we are new at this. Only by knowing where we started will we know how far we got. When we build our tools we also need to have in mind that we will collect data across time. This impacts the tool in itself – if I build a graph, does it allow me to add a data point for multiple measurements? But also the instrument – if I make multiple measurements, I need to use the same instrument for me to be able to measure the impact I’m having on my activities across time.

Channel and HR marketing campaign performance

The indicators we can measure here pertain to the actual type of channel but a few examples are the numbers of posts, impressions, people reached, views (for videos), reactions, comments, shares and the percentage of engagement rate . The tools we now have available do not separate between engagement (on social media) of our own employees and of those we aim to target. But it turns out we don’t even need to make a distinction between the two: a good engagement from even our employees will lead to a higher visibility of the post and thus it will translate in a higher reach towards external audiences. So, instead of becoming demoralized, we should capitalize on the fact that we have high engagement from our employees.

In terms of how often we should measure, generally, such KPIs are measured once per quarter. And to make things easier, there are various tools that can help us track progress on online campaigns and these are generally embedded in Google or the platforms on which we post the campaigns. What is yet to be developed though is the dream of anyone having to work with data: an integrated platform where we can find all KPIs in one go, enabling us to make quick data-based decisions.

Final thoughts, challenges and advice

Dragos Gheban, Managing Partner @ Catalyst Solutions provided us with a few thoughts from his vast experience on employer branding strategies in Romania and Central and Eastern Europe.

“In terms of employer branding and compared to other markets in our area, the Romanian market is quite mature. However, we also see that the market is quite heterogenous in the sense that some organizations focus on just one indicator when measuring progress on their EB strategies and others on a variety. There is, however, great pressure to measure recruitment KPIs. This stems especially from decision makers and it’s not necessarily constructive because once you start measuring the efforts of your employer branding team by means of a recruitment indicator, you kind of set them up for failure. Employer branding is a long-term process and this pressure forces employer branding practitioners to deploy recruiting tactics which normally fall outside the scope of an employer branding team. For instance, implementing job ad campaigns is something that someone in the recruitment team should do. The employer branding team should focus on creating a competitive advantage for your employer brand and this takes time. There are no brands built overnight and even if they are, they’re just a few and shouldn’t be used as benchmarks.”

If you want to learn more about the employer branding KPIs you can measure, take a look at this other article we wrote on the subject.